In our modern working world, more and more individuals are performing jobs on a contract basis. Whether a tradesperson for hire or someone working part-time in the Peach State’s gig economy, many are unsure if workers’ compensation is available for independent contractors.

Technically, independent contractors are self-employed, meaning they’re both employer and employee. However, Georgia state laws that define independent contractors are complex. Even though someone may not be a standard W2-type employee, they still may be entitled to workers’ compensation benefits.

Independent Contractors: Factors That Affect Status

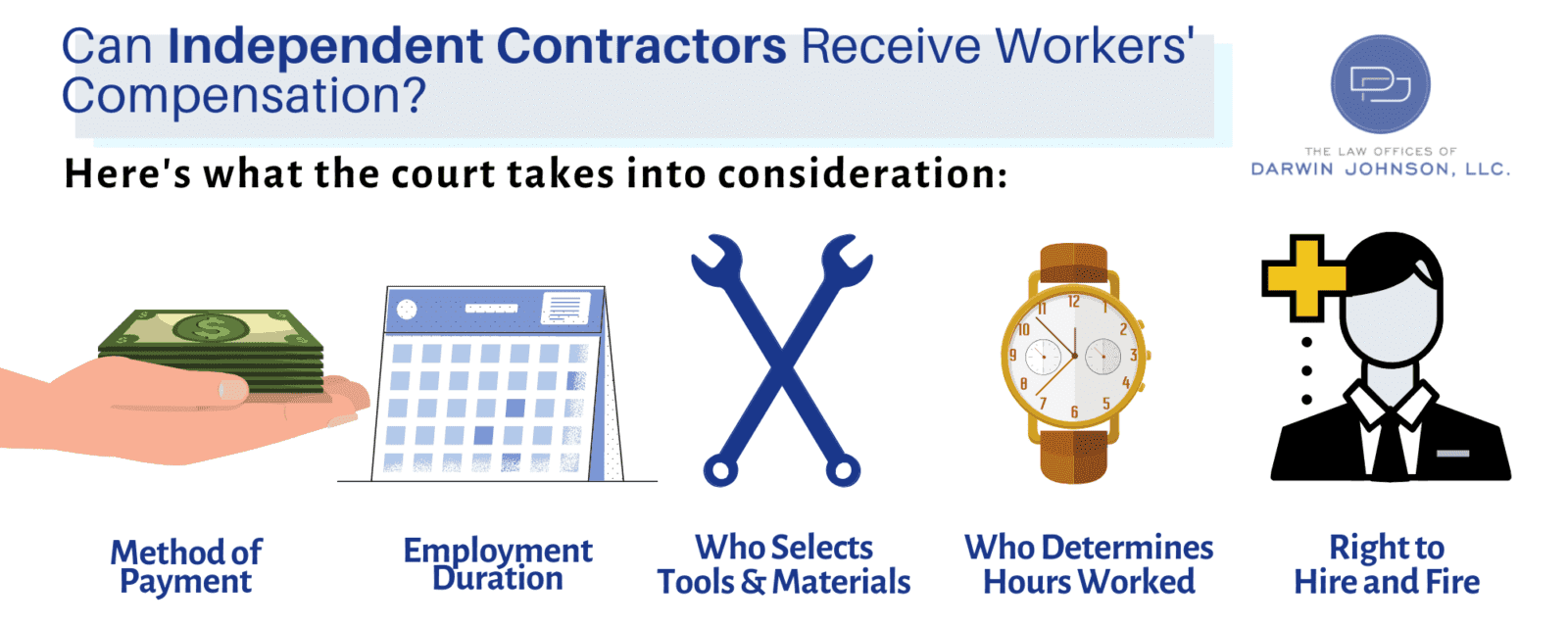

To qualify for workers’ compensation, an employer-employee relationship must exist. Even if you receive a Form 1099, Georgia courts hold that you still may be considered an “employee” if the employer assumes control over the time, manner, or method of employment. When determining whether or not someone is an independent contractor or an employee, the courts will consider several factors, as outlined in the infographic below:

Employee vs. Contractor: A Real World Example

In Golash v. Cherokee Cab Co., Georgia’s Court of Appeals was faced with the decision of whether or not a cab driver was technically an employee, and therefore due workers’ compensation benefits. The court put the “right to control” test into practice, where they assessed whether the employer had the right to control and direct the cab driver’s work per the employment contract.

Some pertinent facts of the case:

- The employer had the authority to instruct the driver when to arrive at work.

- The employer communicated with the driver in regards to the duration of shifts and when to stop working for the day.

- If the driver in question did not obey the employer’s directives, the employer had the authority to terminate them.

Given the evidence, the court determined that because the employer exerted control over “time, manner, or method” of the driver’s employment, the individual was to be considered an employee, and therefore eligible for workers’ compensation benefits.

If your employer claims you are an independent contractor not entitled to benefits and you’re convinced otherwise, it’s time to turn to a trusted workers’ compensation lawyer. For more information about how our attorneys can help, contact The Law Offices of Darwin F. Johnson today!

The post Can Independent Contractors Receive Workers’ Compensation? appeared first on The Law Offices of Darwin F. Johnson.